A brand audit takes a strategic look at your brand’s accomplishments, covering its goals, internal adoption, market position, and overall reputation. It aims to identify opportunities to improve your brand. This could mean spotting inconsistencies in how your brand is communicated internally or determining areas where your brand identity doesn’t match customer perceptions.

Many companies work with a branding agency to get a neutral, third-party view of their brand’s performance, or your brand team can run the audit independently. Use this step-by-step checklist (and free template) to audit your brand.

Step 1: Prepare for your brand audit

Prepare for your brand audit like you would any other important project. Set objectives, identify stakeholders, agree timelines, and secure budget.

Set brand audit objectives

Companies often have one of two major goals when performing a brand audit:

- Understanding the internal performance of their brand (including cross-company adoption, global and local use, and brand consistency)

- Understanding the external perception of their brand (including market share, competitor positioning, reputation, and brand visibility).

We’ll cover both in this checklist, so feel free to skip any steps that aren’t as relevant based on the objectives for your audit.

Identify key stakeholders and collaborators

Here are some of your most important collaborators and stakeholders, and how they can support your audit:

- Business leaders (including the CEO and CMO): They can give high-level input about the brand’s value and identity and provide information on how investors or competitors perceive it.

- Brand managers: They have the most visibility into day-to-day branding efforts and will likely already track several key performance metrics. Brand managers will know about upcoming projects, including campaigns or rebranding initiatives.

- Marketing leaders: They can share ongoing marketing projects, campaigns, and activities, including how these perform. They also have insight into competitors and key differentiators.

- Sales leaders: They interact with customers regularly and will be most aware of how consumers perceive the brand and how it compares to others in your industry.

Agree project timelines

Your brand audit timeline will vary depending on the size of your company, volume of brand materials, brand complexity (such as global or regional variations), and size of team involved in the audit. Here is an example timeline; bigger companies with more complex brands may need to allow more time for each stage.

Secure budget and resources

Like your timeline, the budget and resources required for your brand audit will vary depending on your company size, and whether you’re using an external partner or running the audit with your internal team. Here’s a brief overview of resources and budget items to consider for your brand audit.

- Brand consultant or agency partner

- Research tools, such as competitor analysis, customer and market surveys, analytics platforms, or data visualization

- Internal team time required from leadership, marketing, sales, and other departments gathering brand materials, sharing insights, attending meetings

- Brand team time spent gathering brand materials, external data, analyzing and reporting on findings, and developing an action plan.

Step 2: Gather data on internal brand adoption and performance

Now, you want to gather data about your brand from your internal team. At this stage, you’re just collecting information — don’t worry about identifying trends or patterns.

- Ask employees: Examine how employees in different departments and regions describe your brand, values, and mission. Look for commonalities and differences between teams.

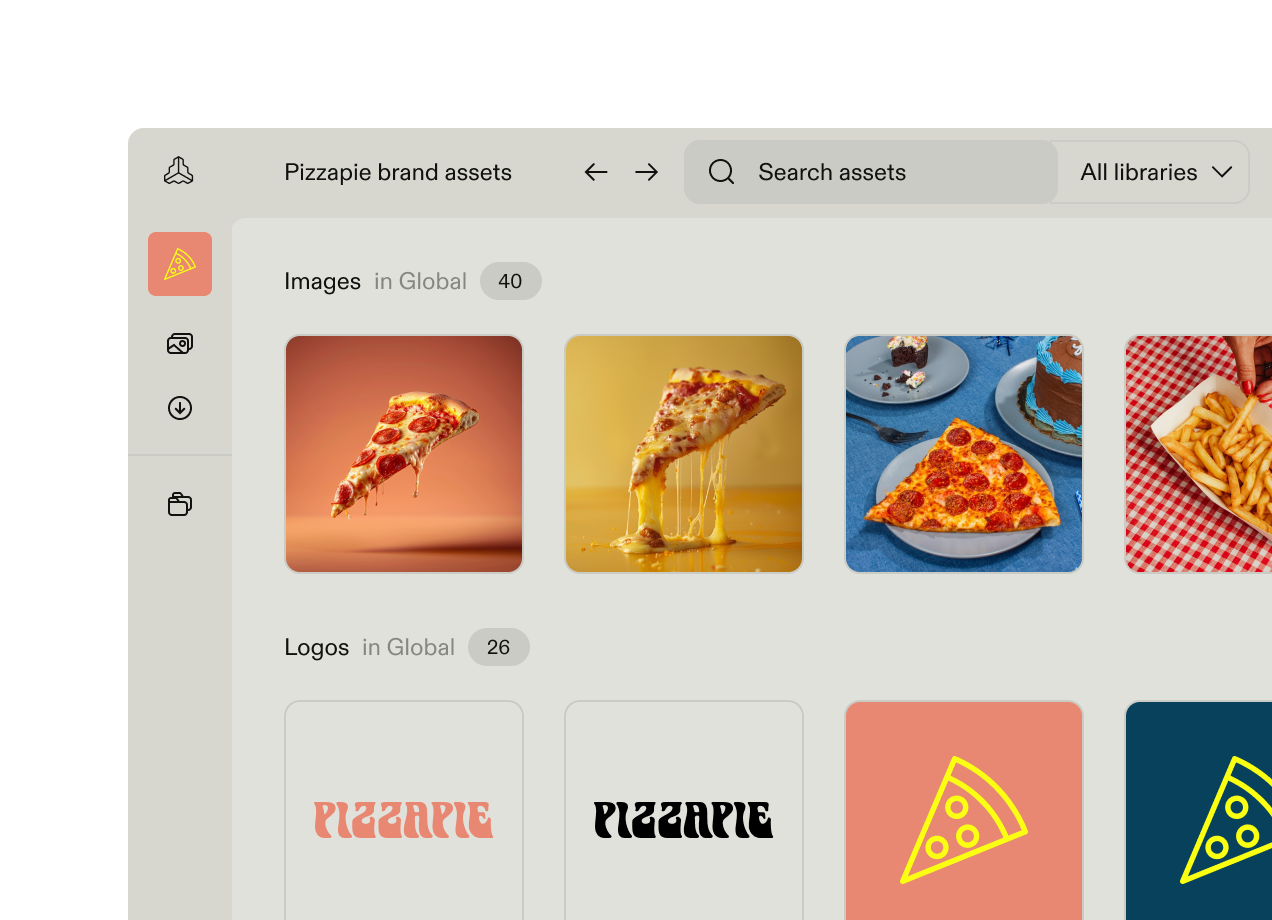

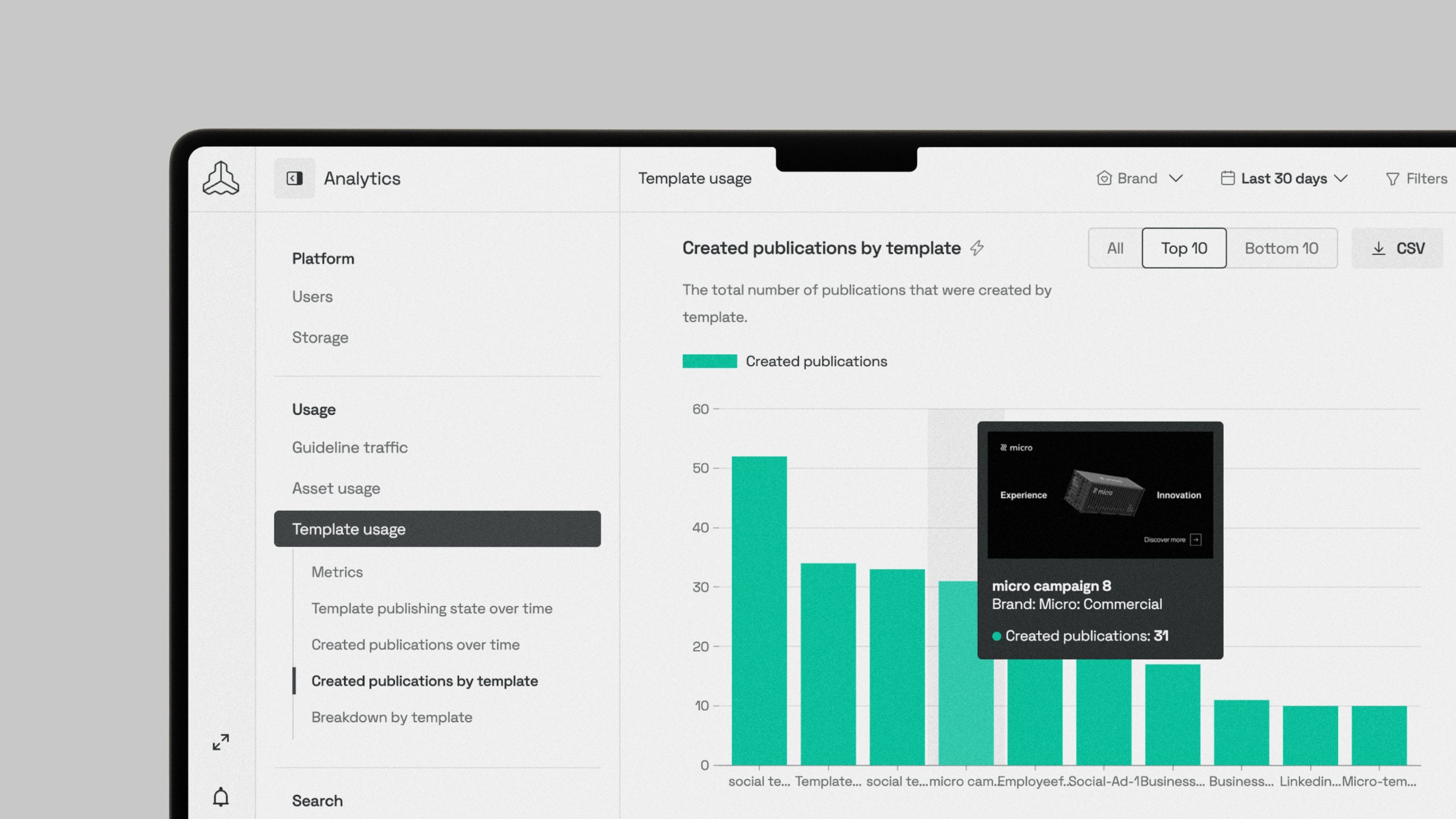

- Measure asset usage: If you work with a DAM, check the system’s analytics to track how brand assets are used. To get a feel for engagement and adoption across the company, look at which teams employ your assets the most and which are the most frequently used assets.

These sources provide quantitative data and qualitative insights about your internal brand performance and adoption, across all teams and business locations.

Step 3: Review brand collateral

Collect examples of brand assets created by different departments and published on various channels. For global brands, make sure to collect brand materials from different regions too, to understand how different countries adapt or localize your branding for each market.

Additionally, take inventory of all your core brand elements, including logo, color palette, fonts, icons, and other core imagery. Check whether you have lots of duplicate or near-duplicate elements, which may cause confusion for your teams, and if there are any missing brand elements.

Step 4: Perform a competitive analysis

Competitor analysis helps you understand your brand’s position in the market.

First, make a list of your most relevant direct and indirect challengers. Then, compare your brand’s positioning with those competitors. In particular, look at their visual branding, messaging, and positioning. Your sales leaders will likely have the best insights here, so get them to share their comparison documents.

You may also find it helpful to work through a SWOT analysis of your brand against your competitors. Consider doing one for each of your major competitors, and one comparing your brand against the whole of the market. Cover these key areas:

Step 5: Conduct audience and customer surveys

Next, you want to collect data about how your brand is perceived by your customers, target audience, and wider market.

Use surveys to collect feedback about your brand. You can send surveys directly to segments of your customers, and run market or audience research surveys using tools such as SurveyMonkey or Pollfish. If you’re working with an agency partner, they may be able to recommend or set up the market research surveys for you.

When surveying your customers, find out what they like and dislike about it and why they choose your product over competitors. Ask questions that focus on two key areas:

- Brand preference: The degree to which consumers would choose your brand over your competitors’ solutions.

- Brand loyalty: How likely are customers to keep buying from your brand and continuously choose it over your competitors’ offerings?

For more general audience research, focus on questions that help you assess brand recognition and your position in the market:

- Brand recall: Whether people recognize your brand, aided or unaided

- Brand perception: Whether people feel positively or negatively about your brand, and what things come to mind when they think of your brand

- Competitor comparison: How people rank your brand against your competitors for different qualities.

Step 6: Analyze brand consistency

Use the brand collateral you’ve collected to assess the levels of brand consistency across the business.

Organize your assets by department or channel. Then, check how successful your teams are at presenting a consistent brand across all channels. Look for visual coherence in logo usage, color palettes, and asset usage. You should also check for messaging consistency.

This review process will help you evaluate how well each department understands your brand and how successful you’ve been at achieving internal alignment. Give each department a score to help quantify how successful they are at implementing your branding.

Once you have reviewed collateral from each department, identify some specific action points to help them improve brand consistency in their work. This could include bespoke training sessions, more detailed brand guidelines, or designating a brand champion for each department.

Step 7: Assess brand visibility

Another core component of a brand audit is evaluating how visible your brand is across key touchpoints — both online and offline. You want to understand where you’re showing up, how often, and how you compare to competitors.

Start by defining the channels that matter most to your brand (e.g., search, social, retail, events, partner ecosystems) and then assess performance using a consistent set of visibility metrics.

These metrics help you compare your brand presence with competitors. By tracking the numbers over time, you can see if your visibility is growing and your brand investments are paying off.

Look for patterns and inconsistencies. Are certain regions, teams, or channels underperforming? Is your brand highly visible but inconsistently presented? These insights can inform decisions about campaign investment, channel prioritization, and brand governance.

Step 8: Evaluate brand reputation

An externally-focused brand audit should help you understand how consumers and the wider market perceive your brand — whether it’s trusted, differentiated, and emotionally resonant with the audiences that matter most.

Start by identifying your priority audiences (customers, prospects, partners, employees) and evaluate how each group perceives your brand across key dimensions such as quality, reliability, innovation, and values. Use these metrics to make your brand reputation measurable, so you can track changes over time.

Beyond these high-level metrics, gather qualitative feedback to provide additional context about your brand reputation. You can collect feedback in several ways:

- Review platforms: Analyze reviews on sites like G2, Capterra, or Trustpilot to identify recurring strengths, weaknesses, and language customers use to describe your brand.

- Customer surveys and interviews: Ask open-ended questions to understand why customers choose (or leave) your brand.

- Customer-facing teams: Sales, customer support, and success teams are often the first to hear perception shifts — build a feedback loop to capture and categorize these insights.

Step 9: Report on audit findings

You’ve collected lots of data about your brand, so it’s time to bring it all together and report on your findings. Different stakeholders need different levels of detail, so you may want to create a couple of versions:

- Executive one-pager for leadership, board members, executives: This should focus on high-level brand health, competitor positioning, and business impact. Highlight the biggest risks and opportunities, and 3-5 recommended next steps. Present this in a short meeting and talk through the implications for 10-15 minutes. Don’t worry about sharing raw data — keep it skimmable and quick to digest.

- Operational report for brand and marketing teams: This should be more detailed (10-20 pages), sharing your methodology, evidence, and tactical recommendations. Include detailed metrics, channel-level insights, examples of inconsistent execution, and supporting qualitative feedback. Host a working meeting to discuss the top 3-5 findings from your audit, and to agree on next steps.

- Appendix or data pack: Document and bring together all your raw data, survey questionnaires and responses, market research, and competitor data, so you can easily replicate in future audits or if teams want to dig in to any aspects of your audit in more detail

- Interactive dashboard: A real-time dashboard for tracking your brand KPIs over time, to help you monitor ongoing performance.

Use images, charts, tables, and diagrams to illustrate key points. Turn your quantitative data (such as brand visibility and reputation metrics) into visual charts and graphs to make them easy to digest. Balance quantitative data with qualitative insights. Pull quotes from customer feedback, survey responses, or internal teams that summarize the common themes or trends you’ve identified. These will help to bring the numbers to life and make your findings more tangible.

Step 10: Develop an action plan

If your audit uncovers a lot of areas for improvement, it can be tempting to tackle everything at once. But this can be overwhelming, and can lead to lots of activity with no clear progress or outcomes.

Instead, work with key stakeholders to develop a concrete action plan. This could be broken down into sprints, or form part of your quarterly planning. The aim is to make gradual, sustained improvements to your brand, rather than trying to fix everything immediately.

Prioritize follow-up actions based on your findings and determine the areas with the biggest impact. Set timelines and define responsibilities so it’s clear who will do what to turn your findings into tangible change for your brand.

Here are some areas to focus on:

- Improving brand consistency: Identify ways to improve engagement across internal teams and help each department better understand and adhere to your guidelines. This could involve running training sessions, improving brand documentation such as guidelines, or introducing a “brand champion” for each department.

- Boosting brand visibility: Your brand audit will help you spot channels or market segments where you lag behind competitors. Then you can plan targeted campaigns, prioritize channels, and direct investment to the areas where you stand to make the biggest visibility gains.

- Strengthening brand reputation: Use competitor insights and customer feedback to identify gaps and opportunities. Create a plan to address those perceived weaknesses to develop your brand’s reputation, such as updating messaging or improving the user or customer experience.

To maintain momentum, consider publishing a short “brand health” update report each month, alongside a full audit on an annual basis.

Brand audits should shape your brand strategy

A brand audit should give you actionable information, resources, and ideas to strengthen and improve your brand. These insights help inform your strategy, guide your ongoing efforts, and inform how everyone in the organization brings your brand to life.

That’s why it’s critical to conduct regular brand audits. By regularly checking your brand’s pulse, you spot inconsistencies or reputation challenges as they arrive and create a culture of continuous development and improvement. Use this checklist each time to give you a repeatable framework for evaluating and auditing your brand.